Determining the Payback Period of a Business Investment

Whether implementing new software, acquiring equipment, or leasing more office space, you want to ensure the money you're spending is worth the investment.

One way to determine an investment's viability is through its payback period. This guide explains the payback period and how it differs from the breakeven point and provides a step-by-step method for calculating it.

What Is the Payback Period?

The payback period is the time it takes for an investment to generate income or cash equivalent to its cost. In other words, it's the period needed for an investment to "pay for itself."

Knowing how to calculate the payback period is useful because it helps you assess the risk of an investment and understand its potential impact on your cash flow.

If a potential investment has a short payback period, you'll recover your investment faster. These investments are generally considered less risky. On the other hand, a longer payback period suggests it will take more time to recoup your investment. These investments are typically considered more risky.

Payback Period vs. Breakeven Point

The payback period and breakeven point are related, but they're not the same. The payback period focuses solely on recovering your initial investment. The breakeven point refers to the point at which total revenues equal total costs, considering both fixed and variable costs.

Payback Period Formula

There are two ways to calculate the payback period:

Simple Method

Under the simple method, you use the following payback period formula:

Payback Period = Initial Cost / Average Annual Cash Flow

While this method is simple to apply, it doesn't consider the lifespan of the asset or the effects of inflation.

Discounted Payback Period Method

The discounted payback period formula can provide a more accurate picture of potential investments because it considers the time value of money.

Remember, money available right now is worth more than an identical amount of money in the future because of inflation and because there is an opportunity cost when you spend money rather than saving or investing it.

To use this method, you apply a discount rate, which represents the interest rate expected if you invest the money for a year. You can use either a published interest rate or a company-defined minimum.

The discounted payback period formula is as follows:

Discounted Payback Period = Year Before the Discounted Payback Period Occurs + (Cumulative Cash Flow in Year Before Recovery / Discounted Cash Flow in Year After Recovery)

Because it considers the time value of money, the discounted method usually results in a longer payback period than the simple method.

Payback Period Calculation: An Example

To illustrate how the payback period calculation works, let's consider a fictional trucking company, Speedy Haul, that is looking to invest in new trucks.

Initial Investment: $500,000 (for purchasing new trucks)

Annual Cash Inflows: $125,000 (from additional business generated by the new trucks)

Step-by-Step Calculation: Simple Method

Under the simple method, your payback period calculation would be as follows:

Payback period = $500,000 / $125,000 = 4

This means Speedy Haul will recover its investment in four years through the additional income generated by the new trucks.

Step-by-Step Calculation: Discounted Method

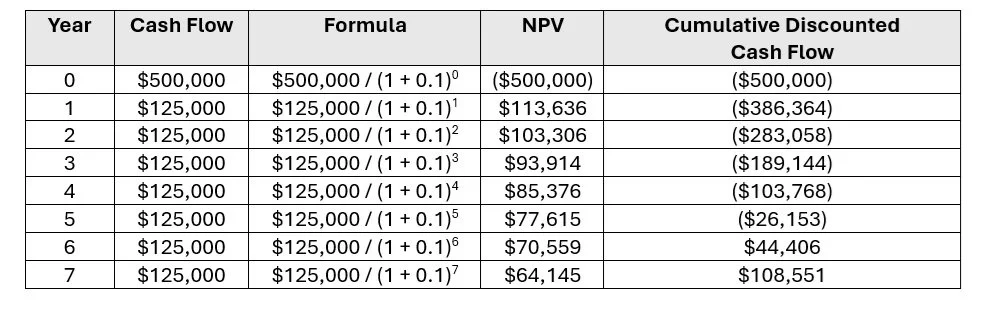

Now, let's consider how the payback period would change if we take the time value of money into account. For this example, we'll assume a discount rate of 10%.

We first need to calculate the net present value (NPV) of cash flow. Speedy Haul's initial investment is $500,000, so we'll call that the cash flow figure for the year before the investment.

To calculate the net present value, we use the following formula:

NPV = Annual cash flow / (1+ Discount rate) Year

So, we calculate the net present value as follows:

This means Speedy Haul will recover its investment in Year 6, when the cumulative discounted cash flow switches from negative to positive. So, the year before the discounted payback period occurs is Year 5.

Finally, we can calculate the discounted payback period using the following formula:

5 + (-$26,153 / $108,551) = 5 – .24 = 4.76 years

Considering the time value of money, this method will take roughly four years and nine months to reach the breakeven point and start turning a profit. As expected, that’s longer than the payback period calculated using the simple method.

Dig deeper into your numbers with Slate

The payback period of a business investment is an essential part of evaluating its feasibility and potential profitability. But it shouldn’t be the sole factor you consider when investing. You should also understand the potential impact on other projects or products, your team members, marketing efforts, and cash flow.

If you need help evaluating business investments, schedule a call with Slate. We’d love to help you dig deeper into your numbers and uncover strategies to support your business goals.